What Is Fractional Ownership? A Beginner's Guide for Australians in 2025

What Is Fractional Ownership? A Beginner's Guide for Australians in 2025

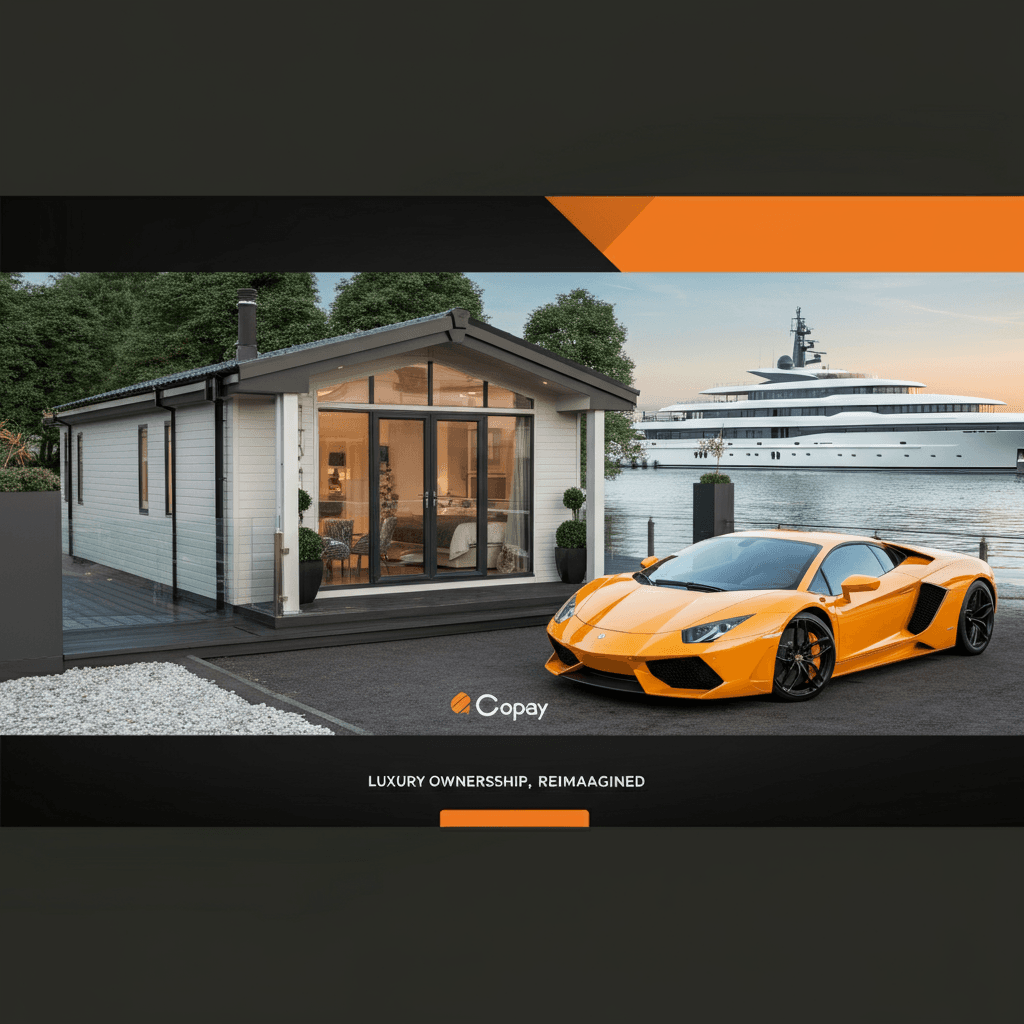

For many Australians, owning a luxury holiday home in Noosa, a high-yield investment property in Sydney, or a yacht to sail the Whitsundays feels like a distant dream. The high cost of entry and the ongoing burdens of maintenance and management make sole ownership a significant challenge. But what if you could own a piece of that dream for a fraction of the cost and effort? In 2025, fractional ownership is making that possible, transforming how we invest in and enjoy high-value assets.

This guide will explain exactly what fractional ownership is, how it works, and why it’s becoming a popular strategy for smart Australian investors.

What is Fractional Ownership, Exactly?

Fractional ownership is an investment model where multiple people co-own a single high-value asset. Think of it like buying shares in a company, but instead of a company, you own a legal, deeded share of a tangible asset—like a property, a boat, or a luxury car. Each owner holds a percentage of the asset, and their rights, usage, and financial responsibilities are proportional to the size of their share.

Unlike timeshare, where you only buy the right to use a property for a set time, fractional ownership gives you true equity. You are a legal owner. This means you benefit from any potential capital appreciation when the asset is sold and can sell your share on an open market. It's a structure that combines the financial benefits of ownership with the practicalities of a shared economy.

How Does It Work? The Simple Steps to Co-Ownership

Modern fractional ownership platforms have simplified the entire process, making it transparent and secure. While models can vary, the journey typically follows a few clear steps.

1. Finding and Vetting the Asset: The process starts with a professionally managed company, like Copay, identifying and acquiring a premium asset. This could be a beachfront home, an apartment in a high-growth area, or a luxury motorhome. The company performs extensive due diligence, covering legal checks, valuations, and financial projections.

2. Structuring the Ownership: The asset is placed into a legal entity, usually a unit trust. This trust is then divided into a set number of "fractions" or "units." For example, a $2 million holiday home might be split into eight fractions, each valued at $250,000.

3. Acquiring Your Share: Investors can then purchase one or more of these fractions through a secure platform. This process involves completing compliant onboarding, signing legal documents, and officially becoming a co-owner with a deeded share in the asset.

4. Professional Management: A key benefit is that a professional manager handles all the day-to-day operations. This includes maintenance, insurance, cleaning, and, for investment properties, managing tenants and rental income. Co-owners pay a proportional share of these costs, but the hands-on work is done for them.

5. Enjoying the Benefits and Selling Your Share: As a co-owner, you get to enjoy the asset. For a holiday home, this means allocated time for personal stays. For an investment property, you receive a share of the rental income. When you decide to exit, you can sell your fraction, benefiting from any increase in the asset’s value over time.

Why is Fractional Ownership a Smart Move for Australians?

The appeal of fractional property investment lies in its ability to solve the biggest problems of traditional ownership.

Affordability: It dramatically lowers the financial barrier to entry. You can access a multi-million dollar property or a luxury yacht for a price that fits your budget.

Diversification: Instead of putting all your capital into one property, you can spread your investment across multiple assets and locations, reducing risk. You might co-own a home in Byron Bay, an apartment in Melbourne, and a boat on Sydney Harbour.

Hassle-Free Lifestyle: It removes the burdens of maintenance and management. You get to enjoy the best parts of ownership—the holidays, the experiences, the financial returns—without the headaches.

Real Equity and Growth: You own a real share of the asset. As its value grows, so does the value of your investment, providing a pathway to wealth creation.

Ready to Start Your Investment Journey?

Discover premium fractional ownership opportunities and build wealth through shared assets.

Explore Assets